Bitcoin (BTC), the world’s first and most valuable cryptocurrency, is often seen as the gateway asset into the digital currency space. Its price trends are frequently scrutinized by traders, analysts, and investors alike. However, for new traders, navigating Bitcoin’s price movements can be intimidating due to its volatility, market sentiment swings, and rapid cycles.

This article explores Bitcoin price analysis through a practical lens, offering actionable lessons tailored for beginners. Along the way, we’ll subtly introduce BYDFi, a user-friendly and professional trading platform that equips new and experienced traders with the tools they need to navigate the complex crypto landscape.

Bitcoin’s price is influenced by a variety of factors, including supply and demand dynamics, macroeconomic conditions, regulatory news, technological developments, and overall market sentiment. Here’s what every beginner should understand:

Bitcoin tends to follow a four-year cycle closely tied to its halving events—a process that reduces the block reward miners receive. Historically, each halving is followed by a bull run, a peak, a correction, and a bear market.

Lesson: Recognizing these cycles helps new traders manage expectations and avoid FOMO (Fear of Missing Out) or panic-selling during downtrends.

Bitcoin is known for its price swings. Intraday fluctuations of 5-10% are common, and weekly moves of 20% or more are not unusual.

Lesson: Volatility should be expected. It can either be your best friend or your worst enemy, depending on how well you manage risk.

Bitcoin’s price often reacts strongly to news and social media trends. Regulatory developments, ETF approvals, macroeconomic data, or tweets from influencers can all trigger significant movement.

Lesson: Learn to gauge market sentiment using tools like fear and greed indexes, social media analytics, and on-chain data.

New traders often make the mistake of jumping into trades based purely on intuition. Instead, it’s better to rely on a combination of technical and fundamental analysis.

TA involves studying price charts to identify patterns and predict future movements.

Common Tools and Indicators:

- Candlestick Charts: Show open, high, low, and close prices.

- Moving Averages (MA): Smooth out price action. Common MAs include the 50-day and 200-day.

- Relative Strength Index (RSI): Measures overbought/oversold conditions.

- MACD: Shows momentum and trend direction.

Lesson: Start with a few key indicators. Don’t clutter your chart with too many tools.

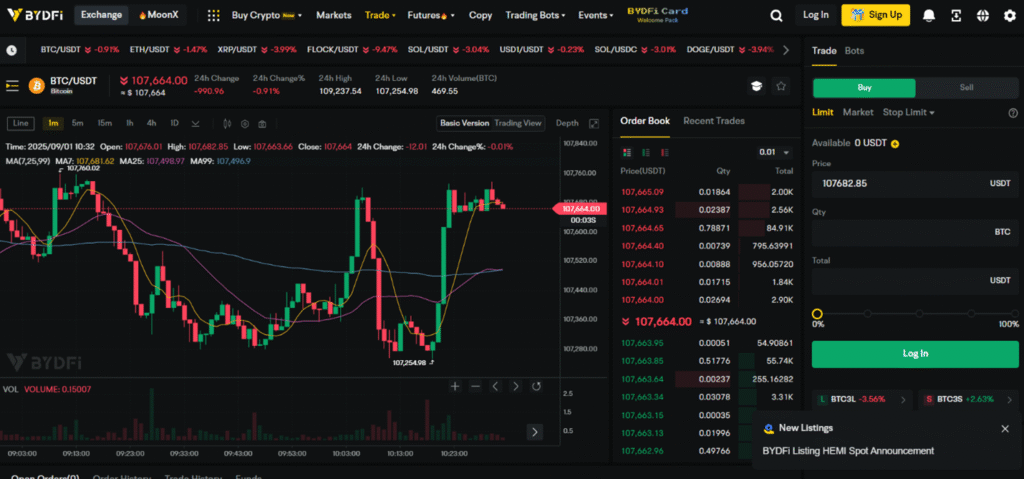

Bonus Tip: Platforms like BYDFi offer built-in charting tools with advanced indicator support, allowing users to customize their strategy with ease.

FA focuses on the intrinsic value of Bitcoin and external factors influencing price.

Key Factors to Monitor:

- Adoption Rates: Growing interest from institutions and retail users.

- Regulatory Landscape: News from major countries impacts sentiment.

- Macro Trends: Inflation data, interest rates, and geopolitical events.

- Network Health: Hashrate, mining difficulty, and wallet activity.

Lesson: Use FA to understand the why behind price movements.

Let’s look at some real-world examples that highlight important trading lessons.

In late 2017, Bitcoin skyrocketed from under $1,000 to nearly $20,000 in less than 12 months. Many late entrants bought near the top and faced a brutal bear market that followed.

Takeaway: Be wary of buying during euphoric peaks. Use dollar-cost averaging (DCA) instead of lump-sum purchases.

After the COVID-19 crash in March 2020, Bitcoin rebounded as institutions like Tesla and MicroStrategy entered the market. Combined with global inflation fears, BTC hit an all-time high near $69,000.

Takeaway: External factors like monetary policy can create bullish catalysts. Keep a macro perspective.

The collapse of Terra, FTX, and other major players in 2022 triggered a sharp market crash. Many over-leveraged traders were wiped out.

Takeaway: Always manage risk. Avoid excessive leverage, and use stop-losses.

Platforms like BYDFi provide flexible leverage options (up to 200x), but they also offer isolated and cross-margin settings, enabling users to manage positions based on their risk appetite.

New traders often enter and exit trades too frequently, hoping to catch every move. This leads to higher fees and emotional exhaustion.

Fix: Trade less, but smarter. Focus on high-probability setups.

Many new traders allocate too much capital to one trade or trade without a stop-loss.

Fix: Never risk more than 1-2% of your portfolio on a single trade.

Emotions like greed (FOMO) and fear (FUD) often lead to poor decisions.

Fix: Create a strategy and stick to it. Use demo accounts to test emotions.

Pro Tip: BYDFi offers a demo trading feature with 50,000 USDT in virtual funds. This allows new users to test strategies in real-time market conditions without risking real money.

BYDFi (short for BUIDL Your Dream Finance) has emerged as a top-tier crypto trading platform with features specifically tailored for both beginners and pros.

- Easy Onboarding: Trade with as little as $10.

- Demo Account: Perfect for learning without losses.

- Copy Trading: Follow expert traders and learn their strategies.

- Advanced Charting Tools: Ideal for performing your own BYDFi BTC analysis using real-time data.

- Low Fees: Competitive fee structure (spot trading fees at just 0.1%).

- Leverage Options: Ranging from 1x to 200x, with protective tools to manage risk.

- 24/7 Support: Live chat and email assistance when you need it.

- Security: Cold wallet storage, segregated accounts, multi-signature technology.

For traders interested in Bitcoin, BYDFi offers both spot and perpetual contract trading options, allowing for different strategies like long-term holding, scalping, hedging, and more.

BYDFi provides a suite of tools that can enhance your BTC trading strategies:

- Trade BTC/USDT with high leverage

- Use cross or isolated margin modes

- Access real-time analytics

- Use Grid Trading to automate buying low and selling high

- Apply the Martingale Strategy to average down in bearish markets

- Mirror trades from top performers

- Learn by observing real strategies in action

The path to becoming a successful Bitcoin trader is not a straight line. You’ll make mistakes. You’ll miss opportunities. But with the right approach, mindset, and tools, you can dramatically increase your odds of success.

Practical Lessons Recap:

- Understand Bitcoin’s cycles and volatility

- Use both TA and FA

- Learn from history

- Avoid common mistakes like overtrading and FOMO

- Use demo accounts and copy trading as learning tools

New traders need more than just enthusiasm—they need a reliable, intuitive, and secure platform. BYDFi delivers just that with its feature-rich environment, low barrier to entry, and industry-leading tools for Bitcoin trading.

If you’re ready to dive into BTC trading or sharpen your skills, exploring a BYDFi BTC analysis feature is a smart next step. With professional-grade tools, a transparent ecosystem, and a supportive community, BYDFi truly helps traders BUIDL their dream finance.